ETF Tax Efficiency Explained

Key Takeaways

- Unlike mutual funds, exchange-traded funds (“ETFs”) are structured to minimize, or even eliminate, the need to distribute short-term and long-term capital gains to shareholders annually.

- In taxable accounts, ETFs offer investors more control over when taxable events occur, as taxes are typically deferred until the investor chooses to sell shares.

- Investing in tax-efficient vehicles like ETFs may result in higher overall returns, as the compounding effect is enhanced by deferring taxes on gains.

Understanding ETF Tax Efficiency

ETFs have gained immense popularity due to their low costs, liquidity, and tax efficiency. But what makes ETFs more tax efficient than mutual funds, and how can investors benefit? This piece dives into the mechanisms that contribute to the tax efficiency of ETFs and provides clarity on why they may be a better option for investors who seek to manage their tax burden in taxable accounts.

The Basics of the ETF Structure

ETFs are a type of investment vehicle that hold a basket of securities, similar to mutual funds. However, unlike mutual funds, which issue and redeem shares directly with investors, ETFs manage supply of the fund through a mechanism known as “in-kind” creation and redemption. This process occurs between the ETF and an intermediary known as an authorized participant (AP).

When investors buy shares of an ETF, the AP gathers the underlying basket of securities that the ETF holds and delivers them to the ETF in exchange for new shares. When shares are sold, the AP delivers the ETF shares back to the fund, receiving the underlying basket of securities in return. Because these transactions occur in-kind between the AP and the fund, rather than an actual purchase or sale of the underlying securities, they typically don’t trigger taxable capital gains for the ETF or its shareholders.

Capital Gains Distributions: A Key Difference

One of the reasons mutual funds often lead to higher tax bills for investors is due to capital gains distributions. When mutual fund managers sell securities within the fund, any realized gains, net of any realized losses, must be distributed to investors at the end of the year. Even if investors didn’t sell any shares of the fund, they may still be responsible for paying taxes on those distributions.

ETFs, on the other hand, rarely distribute capital gains, thanks to their in-kind creation and redemption process. Since securities are exchanged in-kind rather than sold, taxable events are minimized, resulting in less capital gains taxes. This structure helps ETFs defer taxes for investors until they sell their ETF shares.

ETFs in Taxable Accounts and the Compounding Effect in Investment Growth

For investors, the tax efficiency of ETFs is particularly beneficial when investing in taxable accounts. Since most capital gains within ETFs are deferred until the investor sells their shares, tax liabilities are reduced during the holding period. This contrasts with mutual funds, where investors may owe taxes annually, regardless of whether they sold shares.

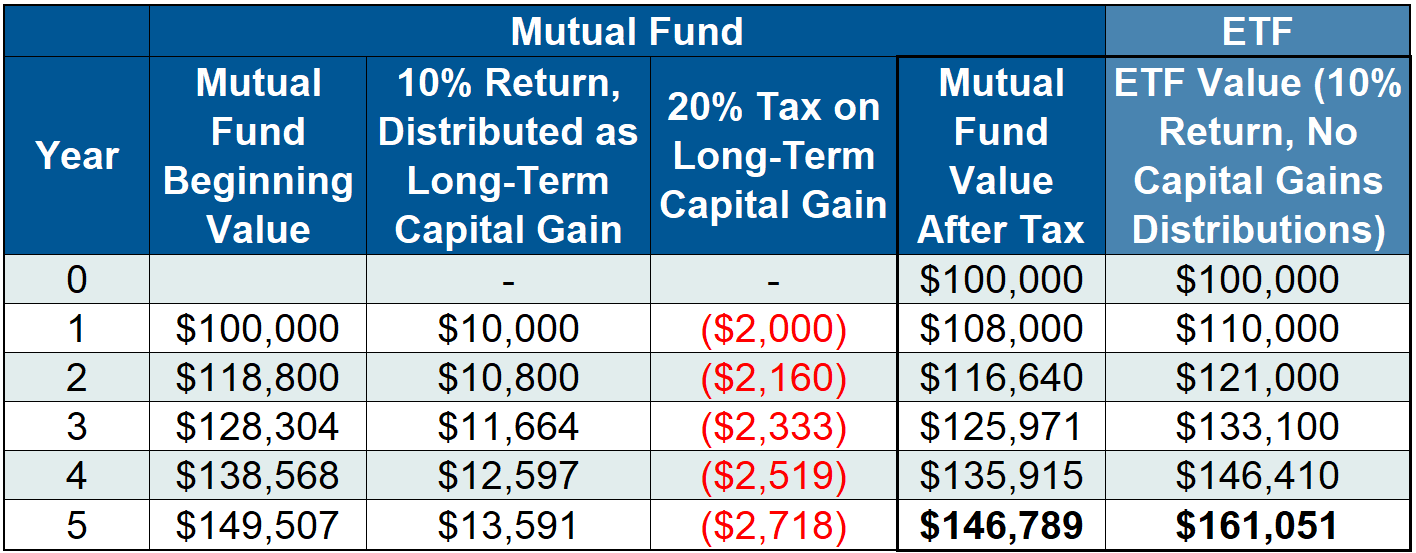

Let’s consider two identical funds, one structured as a mutual fund and the other as an ETF. Let’s assume both funds achieve a 10% return every year for 5 years. The key difference between them is how they handle capital gains distributions. The mutual fund distributes long-term capital gains (LTCG) each year, which are taxed at the investor’s long-term capital gains tax rate (we’ll use 20% for this example), while the ETF distributes no capital gains during this period, allowing the investment to grow tax-deferred, that is, until the investor decides to sell their shares.

We assume an initial investment of $100,000 in each fund. Below is a table that illustrates the difference in compounding between the two:

This hypothetical example is for illustrative purposes only and does not represent the performance of any specific investment or fund. Actual returns, tax rates, and the impact of distributions may vary based on individual circumstances, fund management, and market conditions. Past performance is not indicative of future results. The tax rate used in this example assumes a 20% tax on long-term capital gains, which may differ based on individual tax situations. Investors should consult with a tax advisor for personalized tax advice. Additionally, ETFs may distribute dividends or other income, which could also be subject to taxes. Always consider all investment risks, costs, and tax implications before making investment decisions. Brokerage commissions may apply when investing in an ETF and will reduce returns if applicable.

This example highlights the tax efficiency of the ETF’s structure, in that the absence of annual capital gains distributions allows the ETF to compound higher returns. In contrast, the mutual fund incurs tax liabilities each year, reducing the total capital available for growth. While both investments earn the same return on the underlying securities, the ETF investor benefits from deferring taxes until the eventual sale, which results in a significantly higher final value, all else being equal.

While ETFs generally offer greater tax efficiency than mutual funds, not all ETFs are equally tax efficient. Some ETFs may not fully take advantage of the tax-efficient mechanisms inherent in the ETF structure due to management, operational, or other constraints. Therefore, investors should evaluate the specific tax efficiency of each ETF, in addition to other investment characteristics, before making a decision.

Key Considerations for Investors

When investing, taxes can significantly impact long-term returns. Understanding the tax implications of different investment vehicles can help investors make more informed choices, particularly for long-term holdings in taxable accounts. While tax efficiency should be considered, it should not be the sole driver of investment decisions. Additional factors like expense ratios, liquidity, and investment goals, among others, should also be weighed carefully.

Conclusion

ETF tax efficiency stems from the ETF vehicle’s structural advantage in minimizing taxable events, particularly through in-kind redemptions. This feature makes ETFs an appealing option for investors seeking to reduce their tax liability, especially in taxable accounts. However, understanding the specific characteristics of any ETF is crucial to maximizing its benefits. By offering a tax efficient alternative to mutual funds, ETFs have become a favored tool for tax-conscious investors aiming for long-term wealth accumulation.

The data and analysis contained herein are provided “as is” and without warranty of any kind, either expressed or implied. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. Model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results.

This blog is created and authored by SRH Advisors, LLC (“SRH”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by SRH or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by SRH. The views reflected in the blog are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by SRH), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all SRH clients and investors will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SRH is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of SRH’s current written disclosure statement discussing our advisory services and fees is available upon request.