2024 Q2 In Review: Is the Optimism Easing?

What we saw:

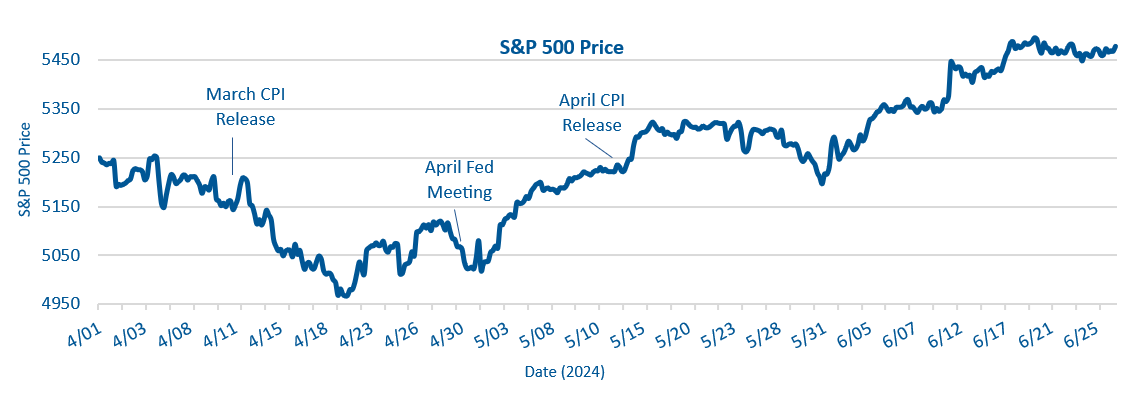

The story of the second quarter largely followed the path we expected, continuing an increasingly familiar intra-quarter dynamic. For three quarters now, we have seen initial weakness in the first month of the quarter, followed by optimism taking over, resulting in strong returns in the last two months of the quarter. The second quarter of 2024 was no different; in April we saw negative returns in the S&P 500, reflecting market participants’ rising uncertainty about the future. At the time, the debate surrounding when the Federal Reserve would cut rates was as hot as ever. Over the course of April, expectations for the number of rate cuts in 2024 continued downward. Then, almost like clockwork, as the first month of the quarter ended, the market turned and started a two-month rally.

As you can see in the chart below, the first major news in the quarter was the consumer price index (“CPI”) coming in at 0.4% month-over-month and 3.5% year-over-year in March (reported on April 10th). This marked the third month in a row that inflation came in higher than expected. From there, the S&P 500 fell below 5,000, notching the low point for the quarter on April 19th.

The Federal Reserve Board (the “Fed”) met for the first time during the quarter from April 30th to May 2nd. As expected, the Fed announced no change in the Policy Rate, butgave some guidance on reducing the Policy Rate in the future that was better than expected. This appeared to be the catalyst that re-ignited the upward trend in the market. The more optimistic tone from the Fed was later bolstered by a lower-than-expected CPI report released on May 15th. Neither the CPI report released in June, nor the June Federal Reserve Board meeting slowed the optimism in the market. After posting a -4.08% return in April, the S&P 500 rallied 8.72% in the last two months to provide a 4.28% return for the entire quarter.

What we’re watching:

Optimism won out in Q2, but it seems like cracks are beginning to show. April saw a larger decline than any month in Q4 2023 or Q1 2024. During the quarter, the market appeared to follow the economic news more closely, instead of ignoring it like it seemed to in previous quarters. A bad inflation report was generally followed by a downward market, while a good inflation report was generally received with an upswing. In our minds, this indicates the spirit of optimism is waning. In our view, the market is starting to act more realistically.

It is harder to predict what the future will bring in this environment. On one hand, we believe the Federal Reserve will likely cut the Policy Rate during their meeting in September. That would be good economic news for the market (even though it is largely expected) and the market could react positively. On the other hand, with the market up so much in anticipation of a cut, it could be a “buy the rumor, sell the news” situation.

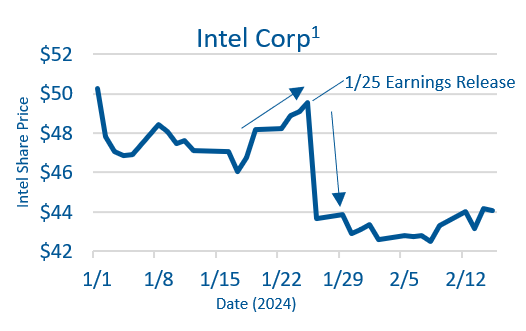

“Buy the rumor, sell the news” is an old stock market adage that encapsulates the market’s ever forward-looking tendency. It is not uncommon for the market to move up in anticipation of an event (the rumor) only to fall after the event (the news) because there is no longer something positive to look forward to. This is why we often see companies experience a rise in share price just before reporting earnings then fall shortly after reporting better than expected earnings. Often, the fall in stock price after an earnings release is because forward guidance is weak.

This happened to Intel Corp (INTC) in Q1 of this year when reporting Q4 2023 earnings. INTC had run up quite a bit with the expectation of strong earnings. It beat estimates on sales and earnings per share, but forward guidance was weak, and the stock fell significantly (sold the news). The market is so forward looking that a good earnings report does not necessarily outweigh underwhelming forward expectations.

Getting back to the current market, we believe that with the Fed potentially cutting the Policy Rate in September the market will look forward to further Policy Rate cuts in 2025, and therefore do not expect a negative market reaction to the news.

While some positive economic data and double-digit growth in the S&P 500 to start 2024 has kept recession concerns to a whisper, we do believe a recession is still possible. Slowdowns have been projected in some industries, and earnings growth expectations are moderate to high right now, so a recession could bring the stock market lower. Should a recession creep into view the Federal Reserve would likely respond with faster rate cuts, which should ease economic pressure, impacting the market positively. It remains difficult to project the magnitude of either response or which would win out, but one of the benefits of a higher Policy Rate is that it arms the Fed with a tool to spur economic growth (i.e., lowering rates) if recessionary concerns arise.

Looking forward, we will be paying attention to inflation and what the Federal Reserve Board is saying about 2025. The other big factor could be earnings growth from companies in the S&P 500. If earnings do not meet expectations, we could see a slide in the Index.

[1] INTC closing price from 01/01/2024 –02/15/2024. Source: Morningstar Direct. For illustrative purposes only.

The statements and opinions expressed here are those of the author. Any discussion of investment strategies represents the author’s views as of the date of the articles and are subject to change without notice.

Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

Definitions

S&P 500 Index: The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S., designed to measure the overall performance of large-cap U.S. stocks and often used as a benchmark for the broader U.S. equity market performance. One cannot invest directly into an index.

This blog is created and authored by SRH Advisors, LLC (“SRH”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by SRH or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by SRH. The views reflected in the blog are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by SRH), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all SRH clients and investors will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SRH is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of SRH’s current written disclosure statement discussing our advisory services and fees is available upon request.